In the rapidly changing e-commerce world, selecting the right online payment processing service is quite significant. It’s all that makes the difference concerning customer satisfaction and your bottom line. With so many options available, things can get a bit confusing. Not to worry! Below, we will review the six best online payment processing services in 2024. Each one of them boasts unique features and benefits for different needs in business.

1. PayPal

PayPal is one of those names that’s across every household and is universally taken for granted when it comes to making payments online. Currently, 400 million people around the world have an active account, which makes this online payment system really good in terms of experience offered to a merchant as well as a customer while following the intended procedure for setting it up and integrating easily with most e-commerce platforms.

One of the crowning features of PayPal is its buyer protection program, which ensures that the customer’s mind is put at ease about online shopping. They also allow you to accept payments in multiple currencies, and thus apt for international businesses. Fees are also relatively competitive and run at usually 2.9% + $0.30 per transaction for domestic sales.

Read more about The Best 5 Blogging Sites to Kickstart Your Success in 2024

2. Square

Square is a great online payment full-service provider. They are very popular among small business operators and retailers. Square also gives more features, such as managing inventory, sales analysis, and so on.

Square’s POS system is highly rated and allows in-store or online payments. They charge a flat rate of 2.6% + $0.10 per transaction, which makes it easy to understand. Additionally, Square has no monthly fees for startups.

3. Stripe

Stripe is the name often selected by tech-savvy businesses and developers because it comes as an extremely customizable payment processing solution with many features. With Stripe, you can accept online payments, manage subscriptions, and even the invoicing for you.

Full API from Stripe is one of the greatest features that enables companies to personalize the payment experience. They charge 2.9% + $0.30 per transaction with no monthly fees. They also accept various types of payments, including credit cards, ACH transfers, and digital wallets.

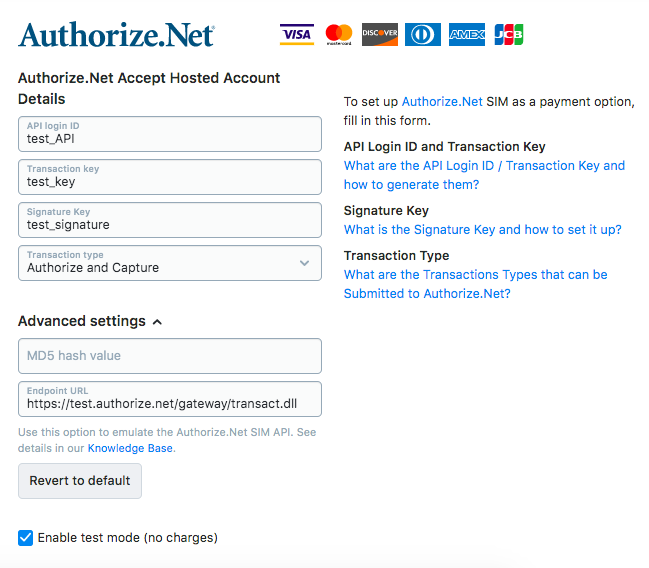

4. Authorize.Net

Authorize.Net is one of the oldest payment gateways around so really trusted. Features included are fraud detection, recurring billing, and even a virtual terminal for payments that were taken over the telephone.

Their integration features are powerful so you can easily integrate with several e-commerce sites. Authorize.Net charges a setup fee of $49 and requires a monthly fee of $25 along with a transaction fee of 2.9% + $0.30. Although it is more expensive than others, the many features make it definitely worth it especially for businesses with a lot of transactions.

5. Adyen

Adyen is a leading payment solution that addresses the needs of large corporations and businesses requiring an international payment solution. It offers a single platform with one interface for supporting multiple payment methods across various channels: online, in-app, and in-store transactions.

Based on the volume of transactions, Adyen is individually priced, and thus convenient for a small, medium, and large business. But they usually charge 0.2%-3% per transaction, depending upon the method of payment used. With the feature of deep reporting and analytics, Adyen puts you in a position to optimize your payment processes.

6. Venmo for Business

Venmo is popular for personal transactions. However, in the business world, it has made its mark as well. Venmo for Business can allow small businesses and freelancers to accept payments really seamlessly. It’s popular nowadays amongst younger consumers who prefer using mobile payment apps.

Venmo transactions are quick, and users have the social features of payments, where people can share transactions with friends. Although there are no monthly fees, to make a business transaction on Venmo, one has to pay a 1.9% + $0.10 fee. This is suitable for small-sized businesses.

Conclusion

In choosing the online payment processing service that would suit your business, you will find differences that will aptly serve your needs. PayPal, Square, Stripe, Authorize.Net, Adyen, and Venmo are options, each with strengths in their own right. You should, therefore, weigh your business model and target clientele against particular needs when making your choice.

Being updated on trends involving payments and consumer preferences will be very important in 2024. A reliable payment processing service would not only boost customer satisfaction but also sustain your business.

So, which payment processor do you think you are going to use in your business? Do let us know in the comments!